Legal Practice Areas

Some Of The Areas In Our Jurisdiction ,

As a replevin agent, our jurisdiction includes several areas such as providing legal assistance, filing necessary court documents, representing clients in court, conducting investigations, serving notice to debtors, and enforcement of judgments. We assist clients in recovering personal property, vehicles, funds, equipment, and other assets that have been wrongfully taken or withheld by someone else. Additionally, we can help in locating missing assets and tracking down debtors who have fled out of state. Our role is to ensure that our clients’ rights are protected and their assets are returned to them in a timely and efficient manner. We work in collaboration with law enforcement agencies, lawyers, and collection agencies to achieve positive results for our clients.

01.

Binary Option Scams

Binary options fraudsters often advertise on social media – the ads link to well-designed and professional-looking websites. The firms running the scams tend to be based outside the UK but often claim to have a UK presence, such as a City of London address

02.

Fake investment's companies

Investment scams involve promises of big payouts, quick money or guaranteed returns. Always be suspicious of any investment opportunities that promise a high return with little or no risk – if it seems too good to be true, it probably is – and is highly likely to be a scam.

03.

Travel prize scams

Travel prize scams are attempts to trick you into parting with your money to claim a ‘reward’ such as a free or discounted holiday.

04.

Ponzi Schemes

Investment scams aim to get unsuspecting people to hand over money – they can seem perfectly legitimate, appearing knowledgeable with websites, testimonials and marketing material. The most famous kind of investment scam is a Ponzi Scheme, where money is collected from new investors to pay previous investors.

05.

Betting Scam

Betting and sports investment scams try to convince you to invest in foolproof systems and software that can ‘guarantee’ a profit on sporting events.

06.

Mobile premium services

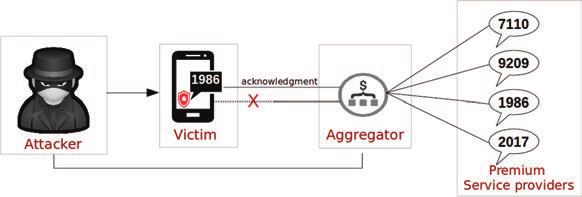

Scammers create SMS competitions or trivia scams to trick you into paying extremely high call or text rates when replying to an unsolicited text message on your mobile or smart phone. Scammers create SMS competitions or trivia scams to trick you into paying extremely high call or text rates when replying to an unsolicited text message on your mobile or smart phone.

Get Started with Your Case

Email us : support@7102.pl

01.

Binary Option

Binary options scams involve fraudulent activities where individuals or companies deceive traders and investors to take their funds. Some common types of scams include: account manager scams, phishing scams, signal sellers scams, trading software scams

02.

Fake investment's companies

Fake investment companies are fraudulent organizations that prey on innocent people to steal their hard-earned money. These companies present themselves as legitimate investment firms, promising investors high returns in a short time frame, but in reality, they are nothing but a scam. Such companies usually operate through online platforms, social media, emails, and other digital channels. They convince unsuspecting investors to deposit their money into fake investment schemes, promising them guaranteed returns such as Ponzi schemes. As soon as the investors put in their money, the scammers disappear, and investors lose all their investment. As a potential investor, it is essential to be wary of these fake investment companies, conduct thorough research and due diligence before investing your hard-earned money.

03.

Travel prize scams

Travel prize scams are schemes designed to entice people into buying travel packages that don’t exist. Consumers may receive an email or a phone call informing them that they are the lucky winners of a free trip or vacation. However, they are required to pay a certain fee to claim the prize, and once they do so, the scammers disappear, leaving them high and dry. The fees may come in the form of taxes, handling charges, or administrative fees.

These scams use various techniques to seem legitimate, such as using the names of reputable travel companies. They prey on people’s desire to travel and explore new destinations. It’s important to remember that legitimate companies never ask for payment to claim a prize,

04.

Ponzi Schemes

Ponzi schemes are fraudulent investment scams that promise high returns with little to no risk. The scheme involves using new investors’ money to pay off earlier investors. The fraudster convinces people to invest by offering unusually high returns, which often mislead people into thinking the scheme is legitimate. However, once the fraudster fails to find new investors to sustain the operation, the scheme eventually collapses, leaving most, if not all, investors with significant losses. Unfortunately, many people have fallen victim to these types of schemes, losing their life savings or even their entire financial future. Ponzi schemes can be challenging to spot

05.

Betting Scam

One common betting scam tactic is to make individuals believe they have won when, in reality, they have not. This scam often involves a phishing email or a phone call that asks the recipient to enter their personal information in order to claim a prize. Once the scammer has this information, they will either ask for an upfront fee or request that the victim completes a series of actions to receive their prize. Unfortunately, once the victim takes these actions, they will either be led to a fake website or receive a message saying that there was an error and the prize cannot be claimed. Some betting scams have even been known to impersonate well-known companies or use counterfeit logos to appear more legitimate.

06.

Mobile premium services

Mobile premium service scams are fraudulent activities that lure mobile phone users into signing up for premium services through deceptive means. These services often promise free content, such as ringtones and games, but in reality, they are costly subscription services that charge excessive fees on the user’s mobile bill. Victims unknowingly subscribe to these services by clicking on an online ad, entering their mobile number, or agreeing to terms and conditions without carefully reviewing them. Scammers benefit from this scam by receiving a portion of the fees generated from the subscriptions. Mobile premium service scams can result in unexpected bill charges, financial loss, and identity theft. Consumers should be aware of these scams and take steps to protect themselves, such as reading terms and conditions before agreeing to them and closely monitoring their mobile bills for any unexpected charges.